Maximizing the ROI of Your Second Home Without Traditional Renting

Owning a second home offers more than just financial rewards. From hosting friends and family for meaningful moments to embracing seasonal adventures, discover how to make the most of your second home.

Owning a second home, once considered a luxury, can now be part of a thoughtful lifestyle strategy. Property owners are discovering meaningful ways to enhance the value of their investment beyond traditional monetary returns.

Owning a second home has become a chance for real connection and personal growth as a result of changing work schedules and priorities around real experiences.

A second home can offer exceptional value for all age groups, from retirees hoping to broaden their horizons through purposeful travel to millennials seeking novel experiences.

This article explores proven approaches for maximizing the personal return on your second home investment. It provides realistic insights and actionable strategies that prioritize human connection over commercial gain.

1. Host friends and family for meaningful gatherings

One of the most fulfilling ways to experience the true value of your second home is by using it to bring people together. You can organize a cozy holiday meal, a milestone celebration, or a spontaneous weekend getaway. These moments offer a rich return emotionally, relationally, and spiritually that no financial investment can match.

2. Create a personal wellness retreat

Transform your second home into a private haven for rest. Equip the space with elements that support your well-being, such as a meditation corner, yoga space, or reading nook with inspiring views.

This approach transforms your property into a resource for personal growth and rejuvenation, offering benefits that far exceed monetary value.

3. Establish a creative workspace

Are you are a professional, writer, or artist looking for concentrated time away from daily distractions? Your second home can turn into a priceless creative sanctuary.

Many creative professionals find that having access to a different environment gives them new perspectives and ideas.

4. Join a home exchange platform

While it might not bring in traditional rental income, home exchanging can save thousands of dollars in travel expenses annually. By swapping homes with others, you gain access to unique accommodations without paying nightly rates.

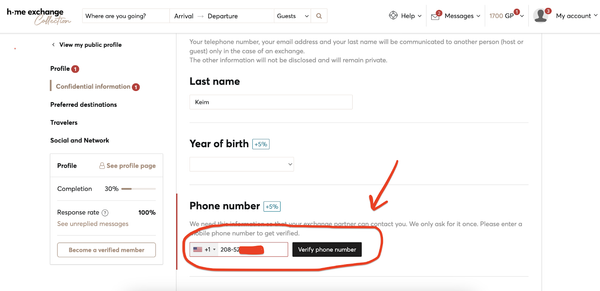

HomeExchange Collection is the premier destination for second homeowners seeking refined travel experiences. With over 360,000 homes and 5000 luxury homes in 155 countries, our platform connects you with like-minded individuals who value comfort, culture, and authenticity.

Membership costs $1000 annually and includes unlimited swaps. Our GuestPoints system lets you host others and earn points to use later, even if you don’t do a direct exchange.

For example, Londoners can have a family from Tuscany over and then use the points earned in that transaction for a stay in Manhattan the following month. This method allows your home to earn you value while you are out of the house.

If your second home is valued at $2M or more, HomeExchange Collection offers:

- A curated network of luxury properties

- Personalized support

- Exclusive member perks

5. Engage with the local community

Becoming part of the local community where your second home is located enriches both your experience and contributes positively to the neighborhood.

Consider joining local organizations, patronizing small businesses, or participating in community events. These connections create a sense of belonging that surpasses the transactional nature of tourism and creates lasting relationships.

6. Share cultural exchanges

Your second home can serve as a base for cultural appreciation and exchange. If you're part of an educational or cultural organization, consider offering your home for cultural ambassadors, exchange students, or visiting artists.

These exchanges foster global understanding and create opportunities for meaningful connection across borders—a value that extends well beyond financial metrics.

7. Create unique personal experiences

If your second home is in a distinctive location, embrace what makes it special by developing personal rituals and experiences tied to that place.

For instance, if your property is in wine country, develop your knowledge of local vintages and cultivation practices. If it's coastal, learn about marine conservation or local sailing traditions. These place-based experiences deepen your connection to the location and enhance the value of ownership.

8. Seasonal appreciation

Many second homes offer unique seasonal experiences that can be fully appreciated with intentional planning. Design your usage patterns to coincide with local festivals, natural phenomena (like fall foliage or wildflower blooms), or optimal weather conditions.

This approach maximizes enjoyment while creating a rhythm of anticipation and appreciation throughout the year.

9. Host skill-sharing gatherings

Turn your second home into a hub for learning and connection by inviting friends, neighbors, or fellow travelers to share their skills in a relaxed, welcoming environment. Cooking classes, photography tutorials, and language exchanges.

10. Create a family legacy

A second home can become a cornerstone of family tradition and legacy. Creating a space where multiple generations gather creates continuity and connection that transcends monetary value.

Consider documenting your family's experiences through photos, journals, or even a dedicated guest book. These artifacts become treasured keepsakes that capture the true return on your investment.

Takeaway: Redefine the value of your second home with proven strategies

Second homes offer value far beyond traditional metrics. Through thoughtful usage patterns, community engagement, and platforms like HomeExchange Collection, these properties become gateways to enriching experiences and authentic connections.

HomeExchange Collection provides a delightful alternative for those who enjoy meaningful travel without sacrificing quality. Our exquisitely designed residences offer an experience that embodies responsible sophistication and genuine connection.

Join HomeExchange Collection today and discover how your second home can create returns measured in experiences, not dollars!

FAQs

This comprehensive FAQ section addresses the most critical questions property owners face when considering how to transform their second home from a personal retreat into a strategic financial asset.

How do I avoid paying 20% down for a second home?

Explore multiple financing strategies to reduce your initial investment. Owner financing gives you the opportunity to directly negotiate terms with the seller and provides an alternative to conventional mortgages. Home equity lines of credit (HELOCs) from your primary residence can provide additional funding options.

Some lenders offer special programs for vacation properties with lower down payment requirements, such as portfolio loans or government-backed programs for specific property types.

What qualifies a home as a second home?

A second home is typically a property you live in for part of the year and is not your primary residence or a full-time rental. Unlike investment properties, second homes are primarily for personal use, though they can generate supplemental income.

The IRS and mortgage lenders have specific criteria: the property must be suitable for year-round use, located at a reasonable distance from your primary residence, and used by you for a certain number of days each year.

Is a second home considered an investment property?

The classification depends on your usage. If you rent out the property for more than 14 days a year, the IRS may classify it as an investment property. This classification impacts tax treatment, mortgage rates, and potential deductions. Investment properties typically face stricter lending requirements and different tax implications compared to second homes used primarily for personal enjoyment.

Is buying a second home a good investment?

Yes, a second home can be a financial and personal asset if it is used wisely. Potential benefits include rental income, property appreciation, tax advantages, and lifestyle perks.

Markets in desirable locations like vacation destinations or areas with strong tourism can offer significant appreciation potential. Additionally, home exchange programs like HomeExchange Collection can help offset ownership costs by providing travel opportunities.

What's the best way to finance a second home?

Conventional loans with 10–20% down are the most common approach. Jumbo loans can be ideal for higher-value properties while cash-out refinancing leverages equity from your primary residence. Consider factors like current interest rates, your credit score, total debt-to-income ratio, potential rental income, and long-term financial goals.

What is the 14-day rule in real estate?

This IRS rule allows you to rent out your second home for up to 14 days per year without reporting the income. It's a strategic opportunity to generate some additional revenue without complicating your tax situation. After 14 days, rental income becomes taxable, and you may need to allocate expenses between personal and rental use.

Can I write off a second home on my taxes?

Yes, if it qualifies as a rental or business property. Potential tax deductions include mortgage interest, property taxes, maintenance and repair expenses, depreciation, and utilities and insurance when used as a rental.

Does a second home qualify for an energy tax credit?

Renewable energy systems like solar panels, wind turbines, or geothermal heat pumps may qualify for federal tax credits only if they meet specific IRS criteria. The credit typically covers a percentage of installation costs, incentivizing energy-efficient improvements.

Is home exchange a good idea?

Home exchange is a good idea. HomeExchange Collection provides cost-free, culturally rich stays and meaningful connections. It offers an alternative to traditional travel, allowing homeowners to explore new destinations while offsetting property ownership costs.

How does home exchange compare to Airbnb?

HomeExchange is based on reciprocity and trust, with no nightly rates. Unlike Airbnb's paid rental model, home exchanges often feel more personal and lived-in. Participants share their actual homes, creating a more authentic travel experience.

Can I use HomeExchange without paying?

You need to pay an annual membership fee, but no additional nightly rates are required. This one-time fee provides unlimited exchange opportunities, making it a cost-effective travel solution.

What is the 30/30/3 rule for home buying?

It is a financial guideline suggesting you should spend no more than 30% of your income on housing, make a 30% down payment, and buy a home priced no more than 3x your annual income.